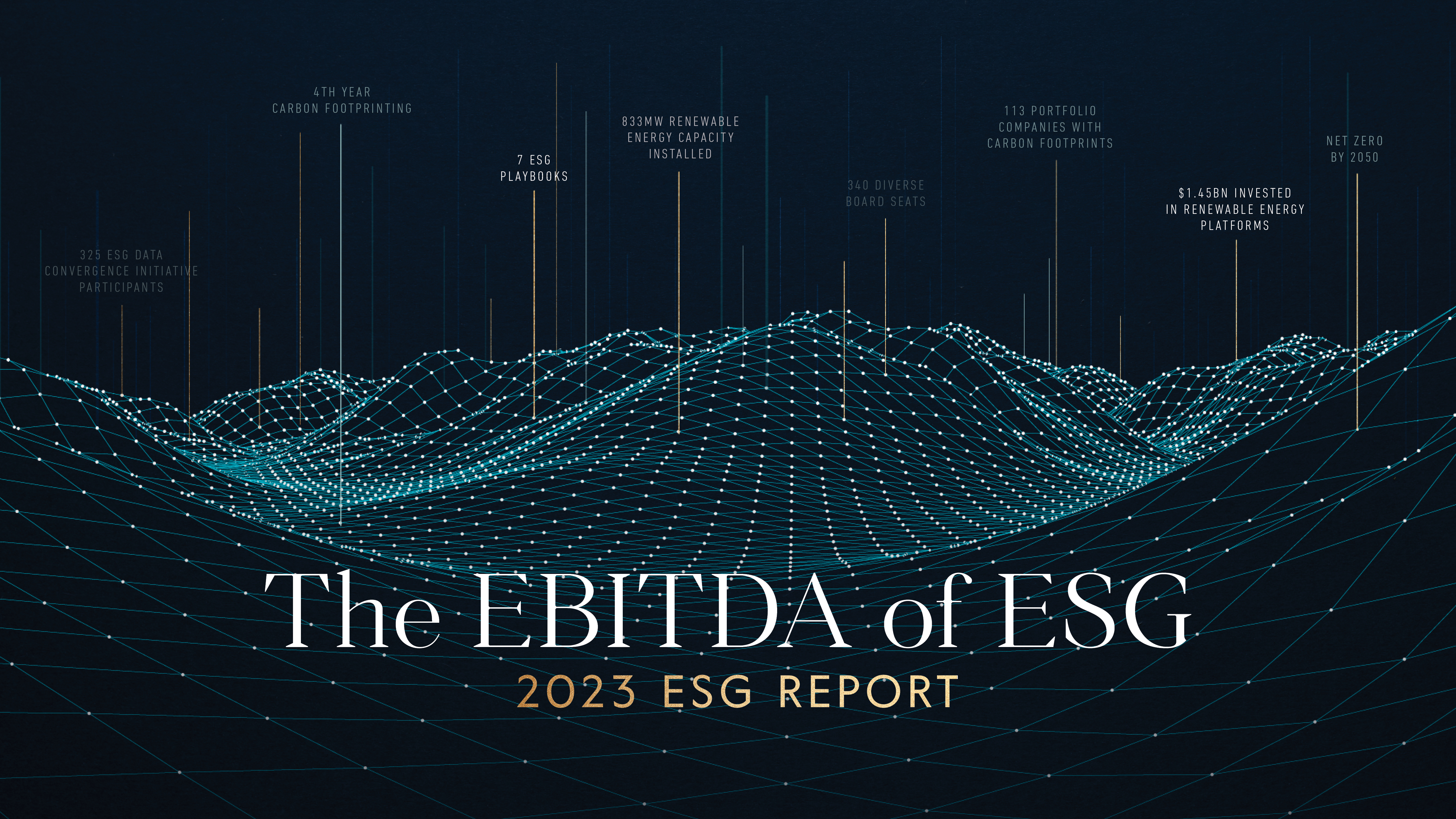

2023 ESG Report

We are pleased to share this year’s ESG report, entitled “The EBITDA of ESG” to reinforce our belief that integrating ESG factors into our investment processes provides an additive lens that we believe can provide opportunities for our portfolio companies to drive revenues, reduce costs, secure more efficient financing, and strengthen their competitive positioning. Enclosed in this document, please also find the 2023 AlpInvest Responsible Investment Report and our third Task Force on Climate-related Financial Disclosures report, summarizing progress towards the climate goals we set in 2022.

Read the 2023 ESG Report

A LETTER FROM OUR CEO

This report highlights our continued work in ESG integration, which builds on Carlyle’s long history and industry leadership in this space. As we reflect on our firm’s progress in 2022, I want to share some thoughts on our approach and priorities as we continue seeking value for our fund investors, shareholders, and companies at the intersection of financial and ESG performance.

First, ESG is a crucial part of our firm’s investment process—it is not an individual product, strategy, company, or fund. Integrating ESG factors throughout our investment processes provides an additive lens that we believe can provide opportunities for our portfolio companies to drive revenues, reduce costs, secure more efficient financing, and strengthen their competitive positioning. We believe ESG can be a means to honing an investment edge in a rapidly changing world and makes us better stewards of capital. As such, we have chosen “The EBITDA of ESG” as the theme of this year’s report in order to reinforce this perspective.

Central to Carlyle’s approach is the belief that we need to invest in the energy transition, not divest from it. In our view, this represents a significant investment opportunity over time. We are committed to using our capital, expertise, and global resources to help companies across industries and sectors be part of and work to build long-term value during the energy transition. Our value creation work ranges from supporting the decarbonization of carbonintensive industries, such as through our partnership with VARO, to seeking to grow energy grid resilience and renewable energy deployment such as through our investment in NineDot Energy, and all sectors in between. Our work is directly connected to our growing Global Credit business, where we’ve sought to be a lender of choice by offering margin discounts across parts of our platform to borrowers that set and hit decarbonization targets, and our Global Investment Solutions business’s work, where we’ve worked with other private equity sponsors to advance their climate reporting and transparency.

As a final point, Carlyle is committed to demonstrating leadership in ESG over the long term. We continue to execute against ambitions that we believe can strengthen the financial performance of our investments, including our net zero goals and, with respect to our portfolio companies, board diversity goals. At the same time, we know real change requires many actors. We are proud to participate in industry organizations focused on solving collective challenges, including through the ESG Data Convergence Initiative, which we co-founded in 2021, and as the inaugural underwriter of The Milken Institute’s DEI in Asset Management Program. Through this industry engagement, we aim to share knowledge from our own firm and portfolio, as well as continue to learn from others.

Carlyle has been focused on integrating ESG for many years, and while we are pleased with our progress, we understand there is still meaningful work ahead. We believe our impact as a firm is rooted in building better businesses and believe ESG is a core lever in this work. Our team remains focused on continuing to improve our approach, data, and tools to deliver better results for investors.