Opportunities in Japan’s Maturing Private Equity Market

Welcome to Up Close with Carlyle, where we look at the investment landscape from a different point of view. In each edition, we share insights from executives across our firm. Subscribe here to be notified of future editions.

“Why is Japan back?” “Is this time different?” “Is this private equity’s moment?”

As Co-Heads of Carlyle’s Japan business, these are some of the many questions we have been asked from overseas colleagues and limited partners (LPs) over the last 18 months as the region has increasingly captured private equity investors’ attention. “Is this short-lived excitement?”, they wonder, or “Are we entering a prolonged period of sustained momentum?”.

The recent yen carry trade unwind and turbulence in Japanese stocks, which set the tone for markets globally, have changed the nature of the questions. “Do you remain optimistic on Japan’s macro story?” and “What does this volatility mean for private equity?”, we are now asked.

Recent events – driven by modest moves in U.S. and Japan rate differences yet amplified by investor expectations – have not altered our view that Japan’s underlying fundamentals remain strong. While the macro environment is always an important consideration for private equity investment, as long-term patient investors we are less concerned with day-to-day market fluctuations.

Our belief is that today’s private equity market in Japan continues to be the most exciting environment we have seen in our careers, and we are at the beginning of a further step-function increase in activity. In this article we look beyond the headlines of recent weeks to unpick the structural drivers behind the industry’s growth and share our outlook for the years ahead.

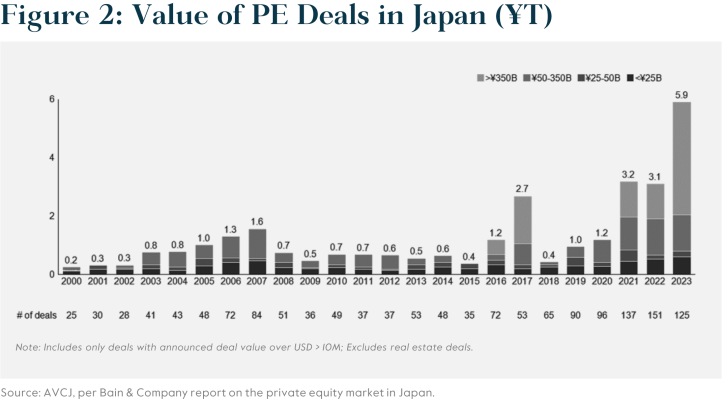

First, let’s look at the numbers. Much has been written of muted global M&A levels over the past 18 months with Japan an outlier as the only major market in the world to record growth. In 2023, the region recorded a 23% year-over-year increase, delivering roughly $123 billion of deal value, according to Bain & Company[1]. A record level of acquisitions was made by private equity investors as the region became the largest PE market in Asia Pacific.

The foundation for this began a decade ago when the Japanese government passed the Companies Act and introduced a Stewardship and Corporate Governance Code. This established measures – such as independent committees and increased appointments of outside directors onto boards – designed to boost corporate productivity. Revisions over the years have further focused management on the cost of capital and efficiency improvements, not least through the inclusion of an enforcement “comply or explain” element. Additional measures from the Ministry of Economy, Trade, and Industry (METI) and pressure from the Tokyo Stock Exchange (TSE) on listed companies have further challenged corporate boards to improve performance.

The reforms have generally worked as intended with companies addressing fundamental inefficiencies in their business, helping to revitalize the Japanese economy from the so called “lost decades.” It has also opened the door to activists who have demanded boards of listed companies streamline operations and boost shareholder distributions. This “rise of activism” has benefited private equity, which often presents itself as an alternative, supportive partner to management – helping to improve the industry’s reputation. The general public, in particular retail shareholders, have become aware of the declining global positions of some once world-leading Japanese brands and have also contributed to the pressure on corporate boardrooms.

Second, we believe overseas investors have seen the attractive valuation multiples of Japanese corporates relative to those in the rest of the world, and the significant margin expansion opportunities this presents. The average EBITDA multiple[2] of the Nikkei 225 Index is 9.5x vs 16.4x for the S&P 500. Furthermore, Japan’s ultra-low interest rates – again regarded as a global outlier – provides a supportive underpinning to M&A activity. Despite the Bank of Japan’s recent tighter policy, interest rates and acquisition financing costs are well below those in the rest of the world and we are seeing that local lenders are highly supportive. LBO financing costs are roughly 2-3% in Japan vs 9-10% in the U.S.

Third, geopolitical factors have been favorable to Japan. In a world of increased tensions, Japan is seen by overseas investors as a stable country both politically and economically. As China’s growth has slowed and trade tension with the West persist, certain investors have tilted away, favoring Japan alongside other Asian markets. (But one should not forget the importance of China to Japanese businesses as the country’s largest trading partner.)

Finally, we believe the mindset of Japanese CEOs today has fundamentally shifted. At the start of our careers, Japanese companies were reluctant to sell their businesses to anyone, not least foreign investors, since it was perceived as a failure of management. It has been fascinating to see how attitudes have changed. With corporate governance and stock exchange reforms now fully embedded into business practices, and disclosure requirements and peer pressure weighing heavily on executives, the role of a CEO today has become more closely aligned with activities that drive profitability.

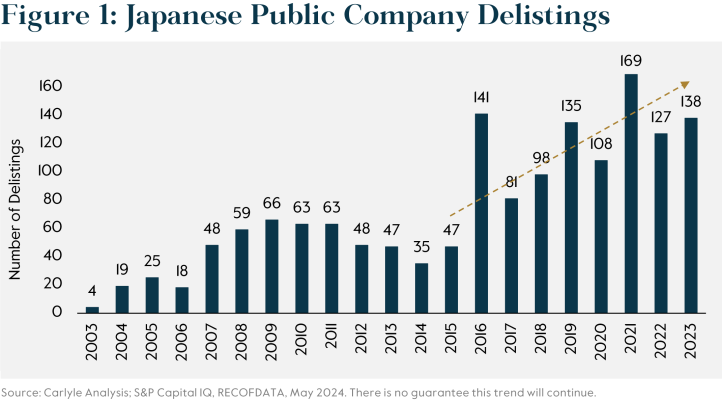

This confluence of factors has driven M&A activity, with corporates distributing more cash to investors, streamlining operations and divesting non-core assets. Delistings have increased three-fold since 2015 (Figure 1).

What’s next for private equity?

While the short-term effects of the recent rate hike are to be further worked through, and longer-term demographic trends will continue to weigh on productivity and economic growth, we expect the M&A market to continue to expand.

Despite considerable growth in recent years (Figure 2), the Japanese private market remains small relative to other large economies. For example it is at least three times smaller than the U.S. PE market and four times smaller than that of the U.K.

We believe the target rich nature of the Japanese market will be a significant catalyst of future activity. In particular, business succession needs are a clear and growing opportunity for private equity investors. The average age of CEOs in Japan is 64 years old – and approximately 1.5 million family-owned companies have not identified a successor. Carlyle has been active in these types of deals over the years. We know from experience that these transactions take time; it is not easy for founders and CEOs to give up control to an outside party. They need to trust that you would be a good steward of their business.

Private equity firms will continue to demonstrate their deep expertise in certain areas that management teams may lack. We believe that two areas that many Japanese businesses can benefit from are an increased focus on digitalization and the application of AI as well as the support needed to accelerate a business’ international growth strategy. These are core skillsets possessed by private equity investors, particularly the large global players, and are ways to help management unlock new avenues of growth.

The confidence in the region in recent years has certainly translated into investor commitments, fueled by some of the highest returns globally. Japanese-focused funds raised more than double the amount in 2023 as compared to the prior year[3]. In fact, Carlyle recently announced the final close of our fifth Japanese buyout fund, which raised JPY 430 billion (c. $2.8 bn). This represented our largest fund to-date in the region at nearly 70% larger than our predecessor fund, and the largest fundraise for a buyout strategy focused on the Japanese market, according to data from Preqin[4].

We are also seeing many overseas GPs establish offices in Japan for the first time. Much of the discussion locally has centered on whether an abundance of capital will lead to increased competition and higher prices. In our view these are sensible considerations, but a feature of any maturing market, as Japan’s private equity industry now certainly is. However, the pressure will now be on how firms can truly differentiate themselves through their strategy, their team, and their track record.

Carlyle’s 24 years of partnering with Japanese companies has taught us the importance of relationship building. While a critical factor in all markets, in Japan it holds paramount importance. Investors should note this market requires not only a deep understanding of Japanese culture but also tremendous patience.

In conclusion, despite the market turbulence of recent weeks, we retain our optimism that the private equity market in Japan will continue to thrive. The normalization of monetary policy may well create further bumps in the road, but the structural drivers of the industry’s growth are compelling. While Prime Minister Kishida recently announced that he will not seek a second term, the many corporate reforms he put in place will likely continue to have lasting effects fueling the industry. We are excited by what the next quarter of a century will bring.

Part of Carlyle’s Global Private Equity business, the Carlyle Japan Partners platform invests primarily in the Japanese upper middle-market across opportunities in Technology, Media and Telecom (TMT), Consumer, Retail and Healthcare (CRH), and General Industries (GIG), and focuses on succession transactions, carve-outs, and strategic take-privates.